Overview

Introduction

API Host

https://api.q2open.io/v1 (production)

https://sb-api.q2open.io/v1 (sandbox)

Resource URL Patterns

/auth

/bill

/company

/payment

/client

Welcome! The Q2 Biller Direct API allows developers to receive user-authorized bill data and make payments on behalf of a user.

Here you will find information on how to integrate with and use the Q2 Biller Direct API. We've tried to make this documentation user-friendly and example-filled, but please drop us a line with any questions.

The Q2 Biller Direct API uses standard HTTP verbs to communicate and HTTP response codes to indicate status and errors. All responses come in standard JSON. The Q2 Biller Direct API is served over HTTPS to ensure data privacy, HTTP is not supported.

Testing

To quickly experiment with the API, you can use Postman. You'll need to set the apiHost and apiKey environment variables.

Testing with Dedicated Test Companies

Always use these dedicated test companies when developing on Sandbox. By using the below listed test companies and the input fields, it is possible to get a auth, bill, or swap into most statuses the end user may encounter. If you are unable to see these companies when searching on Sandbox, please reach out to your Q2 point of contact.

| Input | Description |

|---|---|

balance |

The desired balance |

dueDate |

The desired due date in mm/dd/yyyy format |

status |

The desired auth/bill/swap status |

| Company Name | Description |

|---|---|

| Regular Company 1 thru 5 | A standard company to test against |

| MFA Company 1 thru 2 | A company that requires Code or Prompt Based MFA in order to authenticate |

Legacy Test Company

This testing path will still work, but the new test companies above are the new standard when developing on Sandbox.

You may perform a test authentication with any company to test various use cases. Each use case is triggered based on the username or email used to authenticate. Any password may be used. Here's a list of credentials and their associated test case:

Test Credentials

| Input | Description |

|---|---|

test |

Test a successful authentication. |

testfail |

Test an authentication failure. |

testhold |

Test an authentication hold. |

testmfaquestion |

Test an authentication requiring question-based MFA. |

testmfacode |

Test an authentication requiring code-based MFA. |

testmfaprompt |

Test an authentication requiring prompt-based MFA. |

testpaymentfail |

Test a payment failure. |

testswap |

Test performing a post-authentication swap. Useful when using Connect with a paymentMethodId. |

When a company requires an email as input, append @test.test. to any of the test credentials above. For example, to test an authentication failure, use testfail@test.test.

You may test a successful payment within the Sandbox environment by using 4111111111111111 as the card number, with any valid expiration, zipcode, and random 3-digit CVV.

Legacy Test Company Limitations

- You cannot make payments on Sandbox.

- When using your real account, there may be cases where it will accept invalid credentials or not retrieve your bill data. If you'd like to do a real test with these providers, you'll need to use our production environment.

Gaining Access

To gain access to the Q2 Biller Direct API, please contact us. After our review process is complete, you'll be provided with an API key which you can use for your requests.

Authentication

Authenticate your account when using the API by including your secret API key in the request. Your API keys carry many privileges, so be sure to keep them secret! Do not share your secret API keys in publicly accessible areas such as GitHub, client-side code, and so forth.

Authentication to the API is performed via bearer tokens. Pass your API Key as a bearer token in the Authorization header.

Example Request

curl "https://api.q2open.io/v1/bill/list/579b695decfa11012711875d"

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e"

Errors

Q2 Biller Direct API uses HTTP response status codes to indicate the success or failure of your API requests. If your request fails, Q2 Biller Direct API returns an error using the appropriate status code.

In general, there are three status code ranges you can expect:

2xxsuccess status codes confirm that your request worked as expected4xxerror status codes indicate an error because of the information provided (e.g., a required parameter was omitted)5xxerror status codes are rare and indicate an error with Q2 Biller Direct API's servers

Request IDs

Each API request has an associated request identifier. You can find this value in the response headers, under request-id. If you need to contact us about a specific request, providing the request identifier will ensure the fastest possible resolution.

Getting Started

Our white-label products are the fastest way to implement our API's functionality with a design that fits your branding. If you require a more custom integration you may use the following flow.

User Creation

- User signs up in your app.

- Make a request to the

/clientendpoint to retrieve aclientIdto store in your database for future requests.

Authentication

- Make a request to the

/client/create-tokenendpoint to retrieve a secure SSO token to link accounts. - Link accounts by integrating the Connect product into your application.

Bills

- Requests can be made to the

/bill/list/{clientId}endpoint to retrieve the list of authenticated bills and balance information. - Requests can be made to the

/bill/{billId}endpoint to retrieve details on a specific bill.

Payments

- Provide your user with a "link payment" view to choose a payment method.

- Link this payment method using the

/paymentendpoint. - By default, bills will be paid automatically by using the payment method on file.

- To change this, you must make a request to the

/payment/settingsendpoint to disable recurring payments. - When recurring payments are disabled, in order to make an on-demand payment, one must be scheduled via the

/payment/scheduleendpoint. - You can cancel a scheduled payment for a bill by using the

/payment/cancelendpoint.

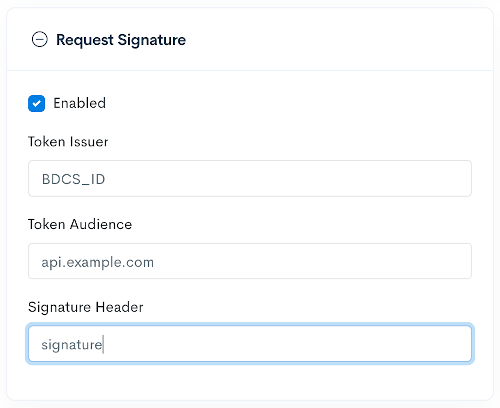

Message Security

RSA/AES Encryption

Example Encrypted Request

{

"encrypted": "os8th269xgj7tyku7wxl",

"hash": "PQ5+gSzli4DyOzXUYqT74QIZ9l4VIyWJipb521HfUnwwj0sNPp0ASyodxb3YOmhbM6nZ+bFXkPN1u2vcXo80yYcMy0xXmfcQ27LRsVjD8kLw7PC0LSfKh1ZHvx+xpxnHDDOYwqRMVFUHIz6ggxPJB39f7hZXRvp5JQQhnB/3JfpV/UvmXjhdQlgC50yOOIJ12S36cnncBrwqYvvDV7iY8Uq6x2ddZRl/2GNoUpnf9jIoKEqeNEpuqoD9g6cwcXXgbjyObxfl6zOSQlfgHJye/Me7E0d+4r0/OWhnSYC6GgedAwUM1fBVGAkAqQKEtU2BYD1kIP8hBSMJxWzVjqKn0A=="

}

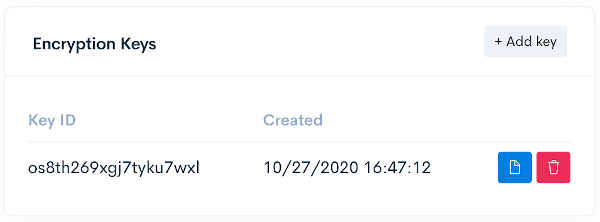

Optionally, message encryption may be used when making a POST request to the API.

- Message encryption uses a combination of AES and RSA encryption.

- The message payload is encrypted using AES-CTR-256.

- The resultant AES key is then encrypted using an RSA 2048-bit public key.

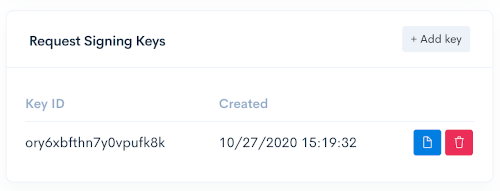

- RSA key-pairs can be created in the Nexus portal

Settingsview, and the public key can be copied.- A maximum of 2 keys can be created for key rotation purposes.

- Public keys are copied in PCKS #8 format.

- Public keys can also be retrieved from the partner public key API.

- The examples GitHub repository includes an example of encrypting the payload with your public key using a combination of AES and RSA encryption.

- Use the API routes as documented, however your payload will be encrypted and base64 encoded using the public key, and sent in a

hashparameter. - Add an

encryptedparameter to your request with the key identifier that is created when you generate an RSA key in Nexus.

RSA Request Signing

Example Signed Request

curl "https://api.q2open.io/v1/client/create-token" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Signature: MzfMtn6M9rpHyzGSvBPkzbNZlne+rf3tkcLUeMUW8mOMmdP1VtnnVdQA9hdYVObjwibOGdRQmCeoI9Xba5DXGT2/l9wOSJQ4FI90DssY1l+orOiwVwY8quAgBUYd2YDDUGyEJ31Y9yOgwLBp2xC4pA5vfkYtWAC9PccdxDyMZcCm6pz3AVgfCRN1m2rcZsE/VrhWhZof3sYitP3zTfV7KCF3T232HPHQtEYtEMLE4Pi7t4i+KvR4Rejt4a7DIgba3OfVmWf5La7WzdlU4eneIPnVjk3CGUo4t9PIPJQVbLyDSIXiF9pRD8ZlW+19XUe/HyWFHR4em00nbaNjBG4TSQ==" \

-H "Date: 2019-09-17T14:14:24.874Z" \

-H "Content-Type: application/json" \

-d '{

"identifier": "5b2bd638bdf6035960b98694"

}'

-X POST

Optionally, 2048-bit asymmetric request signing may be used when making requests to the API.

Keypair Provisioning

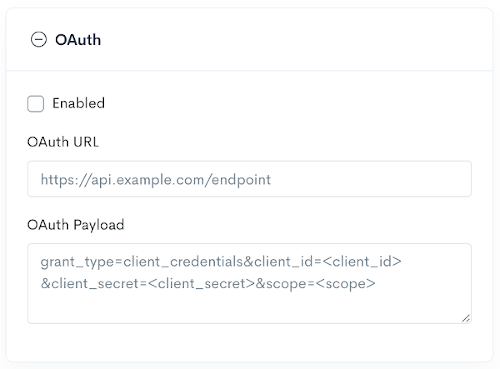

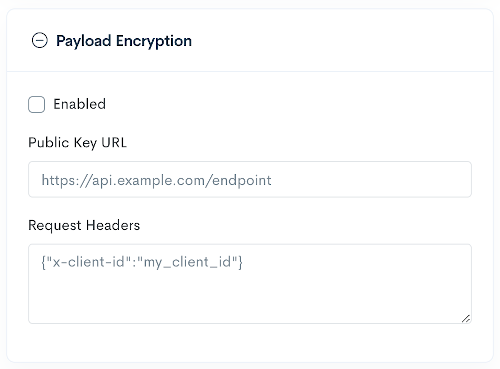

API request signing key-pairs can be added manually in the Nexus portal or in automated fashion by providing an API endpoint.

Manual

- Create a 2048-bit RSA keypair following the PKCS #1/sha-256 signing scheme.

- Update the API Request Signing Public Key in the Q2 Nexus portal

Settingsview.

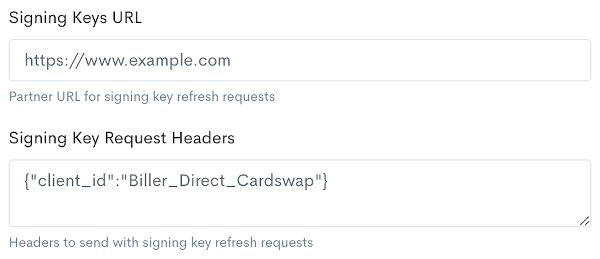

Partner Provided API

An API endpoint may be provided by the partner which the Biller Direct/Cardswap system will use to keep signing keys synchronized. Keys will be requested from the API daily. It is assumed that the expiration of a new partner RSA signing key will be several days at a minimum. If no valid keys are present, the BDCS retrieval job will ping the partner endpoint several times daily to request valid keys. The API must return keys in standard JWKS (JSON Web Key Set) format. Please refer to the JWK standards for more information.

When setting up the API endpoint in Nexus, a collection of headers can also be added if the endpoint requires additional metadata to function. Headers are provided in JSON format.

Signing the API Request

- With each request to the API, generate a signature using the following formula:

- Request method in all uppercase:

POST/PUT/GET/DELETEplus a colon. - Path and query of the request plus a colon.

- Your API Key plus a colon.

- The current date and time in ISO format

- Example:

POST:/v1/client/create-token:YOUR_API_KEY:2019-09-17T14:14:24.874Z

- Request method in all uppercase:

- Use an RSA signing library to create an RSA signature from the signature text with the pkcs1-sha256 signing scheme.

- Encode the produced signature as a Base64 string.

- Add the Base64 signature in the

Signatureheader of the request. - Add the date that was included in the signature to the

Dateheader of the request.

When request signing is enabled, a signature must be provided with every API request.

If the signature is not provided, a 401-Unauthorized response will result.

Products

Our white-label products are the fastest way to implement our API's functionality with a design that fits your branding. We've built a set of products that key in on common use cases of our API. These products include Connect, CardSwap and Biller Direct.

WebView Integration

Integration with our products is straightforward.

- Create a one-time use token by making a call to the

/client/create-tokenendpoint. - SSO into the white-label product by passing in the token as a URL parameter. An example URL would look like this:

https://product.q2open.io?token=123.

Example Code

See our iOS and Android integration examples for example implementations in Swift and Java.

Connect

Host

https://connect.q2open.io (production)

https://sb-connect.q2open.io (sandbox)

Connect is a drop-in module that provides a secure, elegant authentication flow for each company that the Q2 Biller Direct API supports. Connect makes it secure and easy for clients to link their accounts, while doing the heavy lifting for the authentication.

Connect Events

Connect will emit events back to your app using the browser postMessage API, WKScriptMessageHandler on iOS, or addJavascriptInterface on Android, allowing you to decide what to do after the user is finished.

| Event | Description |

|---|---|

auth |

The user successfully authenticated with a company. |

exit |

The user exited the module without completing an authentication. |

alive |

Emitted every 30 seconds to indicate that the user is not idle. |

userPresenceRequired

If the company requires that the user is present to pass through any security flows with every login,

as indicated by the company.userPresenceRequired flag, there are a number of constraints to consider when designing your user experience:

- Bill data cannot be updated ad-hoc without the user first passing through security.

- Payments must be completed in real-time (not scheduled) since the user must be present.

- Likewise, Swaps must also be completed in real-time with the user present.

Instead of calling the typical API routes, you'll need to open Connect to perform these actions immediately after a successful authentication. The user won't need

to re-enter their username and password, but may need to step through security. Using the authId, billId, items, and paymentMethodId URL parameters as

documented below, you'll be able to make payments and swaps in real-time, while allowing users the liberty of maintaining their approach to account security.

URL parameters

The following URL parameters can be optionally passed into the Connect URL to customize the experience.

| Parameter | Description |

|---|---|

companyId |

Deeplink to a specific companyId, skipping the search screen. |

swapId |

Can be used in conjunction with paymentMethodId to move a swap to a different payment method. |

billId |

Can be used in conjunction with paymentMethodId to make a payment when company.userPresenceRequired is true. |

cardPaymentsOnly |

Limit searches to companies that support card-based payments. |

items |

Indicates the next desired action once an authentication is successful. Set to swap to automatically create a Swap. Set to bill to update bill data. Set to payment (in conjuction with a billId) to make a real-time payment towards the balance. |

paymentMethodId |

Sets a previously added payment method to be used for a swap or payment once an authentication is successful. |

URL Examples

To authenticate with a company:

https://connect.q2open.io?token=123&companyId=123&items=bill

To make a payment when company.userPresenceRequired is true:

https://connect.q2open.io?token=123&billId=123&paymentMethodId=123&items=payment

To initiate a new swap:

https://connect.q2open.io?token=123&companyId=123&paymentMethodId=123&items=swap

To move a swap to a different payment method:

https://connect.q2open.io?token=123&swapId=123&paymentMethodId=123&items=swap

To assign the paymentMethodId as the preferred payment method on a bill:

https://connect.q2open.io?token=123&companyId=123&paymentMethodId=123&items=bill

CardSwap

Host

https://cardswap.q2open.io (production)

https://sb-cardswap.q2open.io (sandbox)

Q2 CardSwap™ is the first switch kit for subscription and eCommerce merchants, allowing users to put your card top-of-wallet for their favorite services—all in one place.

CardSwap Events

CardSwap will emit events back to your app using the browser postMessage API, WKScriptMessageHandler on iOS, or addJavascriptInterface on Android, allowing you to decide what to do after the user is finished.

| Event | Description |

|---|---|

finish |

Occurs when the user successfully completes the swap process. Only emits when the startView URL parameter is set to brands. |

URL parameters

The following URL parameters can be optionally passed into the CardSwap URL to customize the experience.

| Parameter | Description |

|---|---|

startView |

Indicates where users are redirected to after completing a swap. Set to brands to skip the introductory page and return users to the brand selection page. |

sessionId |

Session ID to be linked to corresponding Events. |

Biller Direct

Host

https://biller-direct.q2open.io (production)

https://sb-biller-direct.q2open.io (sandbox)

Biller Direct is a card-enabled bill pay solution designed to dramatically improve the user experience and economic model of bill pay.

Biller Direct Events

Biller Direct will emit events back to your app using the postMessage API or WKScriptMessageHandler on iOS, allowing you to decide what to do after the user is finished.

| Event | Description |

|---|---|

alive |

Emitted every 30 seconds to indicate that the user is not idle. |

URL parameters

The following URL parameters can be optionally passed into the Biller Direct URL to customize the experience.

| Parameter | Description |

|---|---|

companyId |

Deeplink to a specific bill for the companyId specified if a bill already exists, or fallback to the authentication screen for the specified companyId. |

billId |

Setting to a specific Bill _id will deeplink the user into the detailed view of the bill. |

skipOnboarding |

Setting to true will skip the introductory screens and animations. |

cardPaymentsOnly |

Limit searches to companies that support card-based payments. |

Sessions

Example Event with

sessionId

{

"event": {

"_id": "580e3e11dec21e861b5a3719",

"type": "session.example",

"created": "2016-04-20T16:51:12Z",

"sessionId": "yoursessionid"

"payload": {

"resource": {

"type": "example",

"id": "579b695decfa11012711875d"

},

"data": {

"example": "session"

}

}

}

}

Adding a sessionId as a URL parameter will link that sessionId to any Events that happen during your customer's session. We recommend creating a new sessionId every time a customer uses a white-label product.

URL Example

https://cardswap.q2open.io?token=123&sessionId=yoursessionid

Auth

Authenticating client accounts can be implemented using the Connect product.

Create auth

Example Request

curl "https://api.q2open.io/v1/auth" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"items": ["bill"],

"paymentIdentifier": "PaymentIdentifier001",

"meta": {

"paymentMethodId": "56e1ddbd1a05319bc198d36f",

"billId": "579b695decea110719b1874d"

},

"clientId": "579b695decfa11012711875d",

"companyId": "579b695decea110719b1874d",

"form": {

"email": "example@example.com",

"password": "12345678"

}

}'

Example Response

{

"success": true,

"message": "Auth has been queued and will respond via webhooks.",

"authId": "579b695decea110719b1874d"

}

Instead of using the Connect Product to handle collecting and verifying credentials, the auth endpoint can be used in conjunction with webhook events and the auth step endpoint to have full control of the user experience. Due to the complexity of the auth process, the webhook events that support this are not enabled by default. Please reach out to your customer support contact to discuss using this feature.

Create auth submits a request to validate given credentials then retrieves bill data, initiates a payment, or performs a swap. Initiating a payment through the auth endpoint is only necessary when userPresenceRequired is true. When userPresenceRequired is true, this means the client is setup on the company's site to use code or prompt based MFA.

HTTP Request

POST https://api.q2open.io/v1/auth

Arguments

| Parameter | Description |

|---|---|

clientId |

ID of client to create the auth for. |

companyId |

ID of the company to validate credentials for. |

items |

What to do after validating credentials. Valid items are bill, payment, and swap. swap should not be used with the others. |

paymentIdentifier |

Optional custom identifier for external system correlation. |

meta.paymentMethodId |

Optional ID of payment method to assign. |

meta.billId |

Optional ID of existing bill. Should not be used with swapId. |

meta.swapId |

Optional ID of existing swap. Should not be used with billId. |

form |

Required login fields that are unique to each company. Usually email/username and password, but sometimes it can be more such as phone number or account number |

Returns

A success message and the new or existing authId for the given company.

Auth Step

Example Request

curl "https://api.q2open.io/v1/auth" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"token": "6218f231494a186f08983d89",

"method": "code",

"security": {

"identifier": "P4erF9C__n73GY",

"answer": "44555"

}

}'

Example Response

{

"success": "true",

"message": "Auth security response has been queued and will respond via webhooks."

}

When create auth requires additional security, the system will send out a webhook asking for answers to questions based, code based, or prompt based style security.

Use the auth step endpoint to respond to security webhook events to progress through the realtime credential validation process.

HTTP Request

POST https://api.q2open.io/v1/auth/step

Arguments

| Parameter | Description |

|---|---|

token |

ID provided by webhooks for correlation to the auth validation process. |

method |

String of the type of response this correlates to: 'questions', 'code', 'prompt' |

security |

Object containing the response to the webhook request for security information. |

didNotReceiveCode |

Boolean used if the user never received the code that was requested. |

Example Auth Webhooks and Steps

Questions Based MFA

Questions Based MFA example Webhook

{

"resource": {

"id": "6217deda4c94a9f552489392",

"type": "client"

},

"data": {

"auth": {...},

"method": "questions",

"input": [

{

"identifier": "ibY1g2PC4wrc6q",

"question": "What is your mother's maiden name?"

},

{

"identifier": "P4erF9C__n73GY",

"question": "What is your favorite color?"

}

],

"token": "6218f985494a186f08983ec2"

}

}

Auth Step for Questions Based MFA

{

"token": "6218f985494a186f08983ec2",

"method": "questions",

"security": [

{

"identifier": "ibY1g2PC4wrc6q",

"answer": "Smith"

},

{

"identifier": "P4erF9C__n73GY",

"answer": "White"

},

]

}

Security questions that are required to verify user. If these are not answered by the client in realtime, they can be answered with Answer Questions

Code Based MFA

Code Based MFA example Webhook

{

"resource" : {

"type" : "client",

"id" : "5d9b819aacffca301b076958"

},

"data" : {

"company" : {...},

"method" : "code",

"input" : [

{

"type" : "text",

"mask" : "xxx-xxx-1234",

"identifier" : "Xf9DWrxK_",

"label" : "Text: xxx-xxx-1234"

},

{

"type" : "email",

"mask" : "e..e@example.com",

"identifier" : "fWaGHa00al",

"label" : "Email: e..e@example.com"

}

],

"token" : "5d9ca25aa71f7c94d0fad1b1"

}

}

Auth Step for Code Based MFA

{

"token": "5d9ca25aa71f7c94d0fad1b1",

"method": "code",

"security": {

"identifier": "Xf9DWrxK_"

}

}

Follow up question for Code Bade MFA

{

"resource": {

"id": "6217deda4c94a9f552489392",

"type": "client"

},

"data": {

"auth": {...},

"method": "questions",

"input": [

{

"identifier": "QMbuXxBKqnDvYC",

"question": "What is the code sent to xxx-xxx-1234?"

}

],

"showRetry": true,

"token": "6218f985494a186f08983ec2"

}

}

Security that asks where the client wants the code sent to. Typically either email, phone number, or a device. This will then be followed up with a webhook asking what is the code that was sent. The field showRetry true means the client can use the didNotReceiveCode for the auth step to try to get another code sent. It should be designed to wait at least 30 seconds before allowing the client to send the try again request.

Prompt Based MFA

Prompt Based MFA example Webhook

{

"resource": {

"id": "6217deda4c94a9f552489392",

"type": "client"

},

"data": {

"auth": {...},

"method": "prompt",

"input": [

"request": "Verify your login with your mobile device"

],

"token": "6218f231494a186f08983d89"

}

}

Auth Step for Prompt Based MFA

{

"token": "6218f231494a186f08983d89",

"method": "prompt"

}

Security measure that requires the user to click a prompt sent to a device or email. The response does not need a security payload as this is just an acknowledgement that the prompt was pressed.

The auth object

Example Response

{

"_id": "579b695decea110719b1874d",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

}

}

| Attribute | Description |

|---|---|

_id |

ID of the auth. |

status |

Status of the auth. |

company |

Company Object |

Auth status

Verified Response

{

"status": {

"type": "verified"

}

}

Authenticate Response

{

"status": {

"type": "authenticate"

}

}

Hold Response

{

"status": {

"type": "hold"

},

"reason": {

"userMessage": "You need to login and verify your account information.",

"code": "account_issue_verify_identity"

}

}

MFA Required Response

{

"status": {

"type": "mfa-required"

},

"mfa": {

"method": "questions",

"mfa": [{

"question": "What city did you grow up in?",

"identifier": "1j5k2l1"

},

{

"question": "What is your favorite food?",

"identifier": "3buw78h3"

}]

}

}

An auth status.type can be a variety of types. Each type is documented below with a description of the status and a typical use case.

verified

The user's auth has been verified. No actions are required.

For Testing this will happen as long as no other valid auth status is entered.

authenticate

The auth's credentials are no longer valid and need to be reauthenticated using the Connect product.

For Testing set status to authenticate. balance and dueDate are ignored.

hold

An auth's status can be hold for several reasons. When an auth is on hold, the response contains a reason for the hold that you can present to your users. To fix the hold, the user must perform the action described in the reason, which usually requires them to log in to their online account. Once the user has completed the action, make a request to the /auth/{authId}/fix-hold endpoint to resume their services.

Additionally, a code is provided for handling the hold programmatically, if required.

Display hold reason

Displayed after user returns to app

For Testing set status to hold. The account_issue_accept_toc hold code will be placed on the auth. balance and dueDate are ignored.

MFA Required

When the link with a company requires additional MFA.

For Testing set status to mfa-required-questions. balance and dueDate are used for bills but ignored for swaps. Additionally to test code and prompt based MFA that requires user to be present, use mfa-required-code and mfa-required-prompt in the status field.

Auth hold codes

Auth hold's include a code - a short string with a brief explanation - as a value for code. Below is a list of possible codes that can be returned, along with our default messaging and the products they relate to.

account_issue_apple_pay_on_file

Your payment method could not be updated because your iTunes payments are made via Apple Pay. Please update your payment method directly through Apple Pay.

account_issue_disney_plus_third_party_on_file

Your Disney+ subscription is currently being paid by a third party provider such as iTunes, Verizon, or the Disney bundle. Sign in to your Disney+ account if you want to change the payment method to your card.

account_issue_payment_details_required

This provider requires additional information. Contact them directly to update your payment method.

account_issue_with_swap

We couldn't update your payment method because of an issue with your account. Please go to the provider directly to update your payment method.

account_issue_primary_account_holder

We can't update your payment method because you aren't the primary account holder for this provider. Please provide the username and password of the main account holder.

account_issue_card_not_accepted

We can't update your payment method because this card isn't accepted by the provider. Contact the provider directly to resolve this issue, then try again.

account_issue_max_cards_on_file

We can't update your payment method because the provider won't allow any more cards to be added. Please sign in directly on the provider's website to remove a payment method and try again.

account_issue_third_party_connected

We couldn't update your payment method because you're paying for your subscription through a third-party provider (like PayPal or Google Play). Please go to the third-party provider directly to update your payment method.

account_issue_third_party_available

We couldn't update your payment method because you're paying for your subscription through a third party, such as iTunes or Amazon. To change your payment method, select the third party from the list of providers to add your card.

account_issue_no_active_subscription

We couldn't add your card because you don't have an active subscription with this provider. Please activate your subscription and try again.

system_issue_with_swap

We couldn't update your payment method because of a technical problem. Please try again.

provider_system_issue

We’re unable to complete the swap because of a system issue with the provider. Please try again later.

partner_expiration_exceeded

This request has exceeded your financial institution's expiration policy.

account_issue_account_locked

Your account has been locked. Unlock your account directly through your provider and try again.

authentication_unsupported

We’re unable to access your account because your login credentials are from a third-party service, such as Facebook or Google. To link your account, disconnect from the third-party service and create new login credentials directly through the provider.

authentication_not_completed

We're unable to access your account because authentication was not fully completed. Please re-authenticate your login credentials and try again.

account_set_up_online_payments

Your account is not set up for online payments. Log in to your account and set up online payments.

account_issue_verify_identity

Please log in to your account to set up and verify your personal information.

account_issue_accept_toc

Please log in to your account and accept the Terms and Conditions.

account_issue_no_service_account

Please log in to your account and add a service account.

account_issue_third_party_payments_on_file

We're unable to access your bill information because your account is connected to a third-party provider.

system_issue_with_bill

We're unable to access your bill information because of a system issue. Please try again later.

system_issue_with_bill_payment

We're unable to submit this payment because of a system issue. Please try again later.

account_paid_in_full

We’re unable to locate a balance on your account because it is paid in full.

account_issue_payment_restrictions

We're unable to submit payments due to restrictions on your account.

account_issue_inactive_account

We're unable to make payments on inactive accounts.

account_issue_no_bill

We are unable to locate a bill on this account. Please contact your provider directly

no_payment_required

There are currently no payments required for this bill because it is in forbearance or your account has been inactive for 6 months or longer.

foreign_currency_issue

We are unable to update or pay your bill due to foreign currency exchange. Please contact your provider directly.

Subcategories for authentication_not_completed

| Code | Description |

|---|---|

invalid-credentials |

The credentials provided are invalid. |

no-mfa-response-received |

The user did not provide a MFA response during a realtime job. |

invalid-mfa |

The MFA response provided by the user was invalid. |

unanswered-mfa-question |

There are MFA questions during the authentication process that the user had not provided answers for. |

Subcategories for system_issue_with_swap, system_issue_with_bill_payment and system_issue_with_bill

| Code | Description |

|---|---|

selector-not-found |

Automation was not able to detect expected selector. |

navigation-error |

Automation job encountered navigation error. |

job-timeout |

Automation job timed out. |

captcha-failure |

Automation failed to solve the captcha on the provider website. |

proxy-failure |

Automation job encountered proxy failure. |

known-system-error |

Automation job encountered known system error. |

issue-unidentified |

Automation job failed due to unidentifiable issues. |

List all auths

Example Request

curl "https://api.q2open.io/v1/auth/list/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-G

Example Response

{

"data": [

{

"_id": "579b695decfa11012711875d",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Time Warner Cable",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/4c805851c738c006546b234e3c3c793d.png",

"background": false

}

}

},

{

"_id": "579b695decfa11012711875d",

"status": {

"type": "authenticate"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "The Grove at Auburn",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/0e9a971a96646da46f5faa68862d0f2d.jpg",

"background": true

}

}

}

]

}

Retrieves a list of client's auths.

HTTP Request

GET https://api.q2open.io/v1/auth/list/{clientId}

Arguments

| Parameter | Description |

|---|---|

clientId |

ID of client to retrieve auths for. |

Returns

A dictionary with a data property that contains an array of auth objects.

Fix auth hold

Example Request

curl "https://api.q2open.io/v1/auth/566595c8ce88ccec69328566/fix-hold" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-X POST

Example Response

{

"success": true

}

HTTP Request

POST https://api.q2open.io/v1/auth/{authId}/fix-hold

Arguments

| Parameter | Description |

|---|---|

authId |

ID of auth to fix. |

Returns

Returns an object with a success property if the hold was fixed. If the authId does not exist, this call returns an error.

Answer questions

Example Request

curl "https://api.q2open.io/v1/auth/{authId}/answer-questions" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"answers": [{

"answer": "Seattle",

"identifier": "1j5k2l1"

},

{

"answer": "Pickles",

"identifier": "3buw78h3"

}]

}'

Accepts a list of answers to the questions presented when an auth has the mfa-required status.

HTTP Request

POST https://api.q2open.io/v1/auth/{authId}/answer-questions

Arguments

| Parameter | Description |

|---|---|

answers |

List of answered questions. |

Returns

Returns an object with a success property indicating the answers were linked to the auth. Returns an error otherwise.

Delete auth

Example Request

curl "https://api.q2open.io/v1/auth/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-X DELETE

Example Response

{

"success": true

}

Deletes an auth and all its items from the account.

HTTP Request

DELETE https://api.q2open.io/v1/auth/{authId}

Arguments

| Parameter | Description |

|---|---|

authId |

ID of bill to delete. |

Returns

Returns an object with a success property if the auth was deleted. If the authId does not exist, this call returns an error.

Bill

The bill object provides you with up-to-date balance, due date, and payment history for a bill. The API allows you to retrieve, list, and check the status of a user's bills.

The bill object

Example Response

{

"_id": "579b695decea110719b1874d",

"auth": {

"_id": "579b695decea110719b1874d",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

},

"items": ["bill"]

},

"autopay ": "unknown",

"autopaySource": "unknown",

"balance": "100.00",

"customPaymentAmount": "50.00",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-25T00:00:00.000Z",

"status": {

"type": "upcoming"

},

"settings": {

"recurring": "enabled",

"schedule": "on-due-date",

"notifications": "enabled"

},

"hidden": "false",

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

}

}

| Attribute | Description |

|---|---|

_id |

ID of the bill. |

auth |

Auth object related to the bill. |

autopay |

Autopay field denotes if this bill is setup to autopay or not on the biller’s site. Possible values are enabled, disabled or unknown. |

autopaySource |

Autopay source field denotes how autopay was set, either by the client or by the biller’s site. Possible values are client, company or unknown. |

balance |

Current bill balance or minimum balance for bills such as credit cards or loans. |

statementBalance |

Current statement balance for bills such as credit cards or loans. |

fullBalance |

Current full balance for bills such as credit cards or loans. |

dueDate |

Current bill due date. |

customPaymentAmount |

Custom amount specified by the user to pay towards their outstanding balance. Only defined if the user has specified a custom amount to be paid. |

customLabel |

Custom label the client created for the bill. |

lastPaidAmount |

Amount of last payment. |

lastPaidOn |

The date when this bill was last paid. |

payDate |

The date when the next bill will be paid. |

status |

Status of the bill. |

company |

Company object related to the bill. |

settings |

Settings for a bill. |

settings.recurring |

Whether or not payments are scheduled automatically. Possible values are enabled, disabled. |

settings.schedule |

The schedule for when a bill payment will be made. |

settings.notifications |

Whether or not the notifications for the bill is turned on. Possible values are enabled, disabled. |

meta.accountNumber |

Account number to differentiate multiple bills on the same auth object. |

hidden |

Hidden field denotes if the bill is hidden from the bill dashboard view. |

Bill status

Syncing Response

{

"status": {

"type": "syncing"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Nothing Due Response

{

"status": {

"type": "zero-balance"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Overdue Response

{

"balance": "100.00",

"dueDate": "2016-03-25T00:00:00.000Z",

"payDate": "2016-03-24T00:00:00.000Z",

"status": {

"type": "overdue"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Payment Required Response

{

"status": {

"type": "payment-required"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

},

"company": {

"requiredPayment": "card"

}

}

Payment Declined Response

{

"status": {

"type": "payment-declined"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Upcoming Response

{

"balance": "100.00",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-24T00:00:00.000Z",

"status": {

"type": "upcoming"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Pending Response

{

"balance": "100.00",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-24T00:00:00.000Z",

"status": {

"type": "pending"

},

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

Paid Response

{

"status": {

"type": "paid"

},

"lastPaidAmount": "100.00",

"lastPaidOn": "2016-01-01T00:00:00.000Z",

"settings": {

"recurring": "enabled",

"schedule": "day-before"

}

}

A bill's status.type can be a variety of types. Each type is documented below with a description of the status and a typical use case.

syncing

Our system is currently retrieving bill data.

For Testing set status to syncing. balance and dueDate are ignored.

zero-balance

Bill data is not available yet. Most common reason is that the user hasn't received a bill. (change image)

For Testing set balance to 0, dueDate to a valid date, and status to zero-balance.

overdue

The due date for the bill has passed, and no payment has been made. Common reasons for an overdue bill are:

- A user adds a bill that is already overdue.

recurringis enabled and the user has no payment method or their payment method's status isfailed.recurringis disabled and a payment has not been scheduled via the/payment/scheduleendpoint.

For Testing set balance > 0, dueDate to a valid date in the past, and status to overdue.

payment-required

The payment method specified by company.requiredPayment is required to pay this bill. A linked payment method must be assigned before bill payments will resume. This can be done via the /payment/{paymentMethodId}/assign endpoint.

No way to test this status as it is rare and requires the company to change its accepted payment methods after the payment method was already assigned to a bill.

payment-declined

The payment method used to pay this bill was declined. To resume bill payments, have the user try their payment method again via the /payment/{paymentMethodId}/retry endpoint, or assign another one via the /payment/{paymentMethodId}/assign endpoint.

For Testing first link the bill by setting balance > 0, dueDate to a valid date in the future, and status to payment-declined. Then schedule a payment for the same billId with no date.

upcoming

The user has a balance on their account and a due date that is in the future.

For Testing set balance > 0, dueDate to a valid date in the future, and status to upcoming.

pending

The system is actively trying to make a payment for the user. A pending payment cannot be canceled.

No way to test this status at this time.

paid

The user has no outstanding balance and has a last paid amount on their account.

For Testing set balance > 0, dueDate to a valid date in the past, and status to paid. Balance will become 0. dueDate and lastPaidOn will be the same. lastPaidAmount will be the balance that was passed in.

Bill payment schedule

A bill's settings.schedule is the number of days before the due date when a bill will be paid. This schedule will be followed when settings.recurring is enabled and the company allows it.

The bill's payDate is the date in which the next bill payment will be made. When recurring payments are enabled, the payDate is calculated by the assigned settings.schedule. When recurring payments are disabled, one-time payments may be scheduled on-demand via the /payment/schedule endpoint. Available settings.schedule options are documented below.

ten-days-before

A payment will be made ten days before the due date.

five-days-before

A payment will be made five days before the due date.

day-before

A payment will be made the day before the due date.

on-due-date

A payment will be made on the due date.

immediately

A payment will be made as soon as a new bill is received.

Retrieve bill details

Example Request

curl "https://api.q2open.io/v1/bill/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-G

Example Upcoming Response

{

"bill": {

"_id": "579b695decfa11012711875d",

"auth": {

"_id": "579b695decea110719b1874d",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

},

"items": ["bill"]

},

"autopay ": "unknown",

"autopaySource": "unknown",

"balance": "100",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-25T00:00:00.000Z",

"status": {

"type": "upcoming"

},

"settings": {

"recurring": "enabled",

"schedule": "on-due-date",

"notifications": "enabled"

},

"hidden": "false",

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

}

},

"payments": []

}

Example Paid Response

{

"bill": {

"_id": "579b695decfa11012711875d",

"auth": {

"_id": "579b695decea110719b1874d",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

},

"items": ["bill"]

},

"status": {

"type": "paid"

},

"hidden": "false",

"lastPaidAmount": "100",

"lastPaidOn": "2016-01-01T00:00:00.000Z",

"settings": {

"recurring": "enabled",

"schedule": "on-due-date",

"notifications": "enabled"

},

"autopay ": "unknown",

"autopaySource": "unknown",

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

}

},

"payments": [{

"amount": "123.12",

"paidOn": "2016-01-01T00:00:00.000Z"

},{

"amount": "153.19",

"paidOn": "2016-01-02T00:00:00.000Z"

}]

}

Retrieve details about a bill including outstanding balance, due date, settings, status, and payment history.

HTTP Request

GET https://api.q2open.io/v1/bill/{billId}

Arguments

| Parameter | Description |

|---|---|

billId |

ID of bill to retrieve. |

Returns

Returns details for a bill if a valid billId was provided. Returns an error otherwise.

List all bills

Example Request

curl https://api.q2open.io/v1/bill/list/579b695decfa11012711875d

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e"

-G

Example Response

{

"data": [

{

"bill": {

"_id": "579b695decfa11012711875d",

"auth": {

"_id": "579b695decea110719b1874d",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

},

"items": ["bill"]

},

"autopay ": "unknown",

"autopaySource": "unknown",

"balance": "100.00",

"customPaymentAmount": "50.00",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-25T00:00:00.000Z",

"status": {

"type": "upcoming"

},

"settings": {

"recurring": "enabled",

"schedule": "on-due-date",

"notifications": "enabled"

},

"hidden": "false",

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

}

},

"payments": []

},

{

"bill": {

"_id": "579b695decfa11012711875d",

"auth": {

"_id": "579b695decea110719b1874d",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

},

"items": ["bill"]

},

"autopay ": "unknown",

"autopaySource": "unknown",

"hidden": "false",

"status": {

"type": "paid"

},

"lastPaidAmount": "100",

"lastPaidOn": "2016-01-01T00:00:00.000Z",

"settings": {

"recurring": "enabled",

"schedule": "day-before",

"notifications": "enabled"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

}

}

},

"payments": [{

"amount": "123.12",

"paidOn": "2016-01-01T00:00:00.000Z"

},{

"amount": "153.19",

"paidOn": "2016-01-02T00:00:00.000Z"

}]

}

]

}

Retrieves a list of client's bills.

HTTP Request

GET https://api.q2open.io/v1/bill/list/{clientId}

Arguments

| Parameter | Description |

|---|---|

clientId |

ID of the client to retrieve bills for. |

Returns

A dictionary with a data property that contains an array of bill details.

List all bills by partnerId

Example Request

curl https://api.q2open.io/v1/bill/listByPartner/616f208da973a0828ecd015c

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e"

-G

Example Response

{

"data": [

{

"bill": {

"_id": "579b695decfa11012711875d",

"auth": {

"_id": "616f208da973a0828ecd0166",

"created": "2021-10-19T19:46:21.685Z",

"status": {

"type": "verified"

},

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

},

"items": ["bill"]

},

"balance": "100.00",

"customPaymentAmount": "50.00",

"dueDate": "2018-10-25T00:00:00.000Z",

"payDate": "2018-10-25T00:00:00.000Z",

"status": {

"type": "upcoming"

},

"autopay ": "unknown",

"autopaySource": "unknown",

"settings": {

"recurring": "enabled",

"schedule": "on-due-date",

"notifications": "enabled"

},

"hidden": "false",

"company": {

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false

},

"schedule": "on-due-date"

}

},

"payments": [],

"partnerUserId": "616f208da973a0828ecd0164",

"partnerId": "616f208da973a0828ecd015c"

},

]

}

Retrieves a list of partner's active bills.

HTTP Request

GET https://api.q2open.io/v1/bill/listByPartner/{partnerId}

Arguments

| Parameter | Description |

|---|---|

partnerId |

ID of the partner to retrieve bills for. |

Returns

A dictionary with a data property that contains an array of bill details.

Company

Company objects allow you to authenticate bills with your users. The API allows you to retrieve and search for companies.

The company object

Sample Response

{

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"categories": ["streaming"],

"status": "operational",

"fullyAutomatedBill": true,

"fullyAutomatedCardSwap": false,

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false,

"svg": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.svg",

"color": "FF041F"

}

},

"requiredPayment": "bank",

"schedule": "on-due-date",

"additionalPaymentOptions": [{

"type": "custom-payment-amount",

"settings": {

"canExceedBalance": false

}

}]

"auth": {

"urls": {

"login": "https://www.netflix.com/Login",

"signup": "https://www.netflix.com"

},

"loginFields": [{

"placeholder": "Username",

"formType": "text",

"name": "username",

"label": "Username"

}, {

"placeholder": "Password",

"formType": "password",

"name": "password",

"label": "Password"

}]

},

"geo": {

"lat": 30.70,

"lng": -95.53,

"state_short": "TX",

"state_long": "Texas",

"zipcode": "77340"

},

"fees": {

"ach": {

"rate": 1.5,

"percentage": false

},

"cards": {

"american express": {

"credit": {

"rate": 1.5,

"percentage": false

}

},

"discover": {

"credit": {

"rate": 1.5,

"percentage": false

},

"debit": {

"rate": 1.5,

"percentage": false

}

},

"mastercard": {

"credit": {

"rate": 1.5,

"percentage": false

},

"debit": {

"rate": 1.5,

"percentage": false

}

},

"visa": {

"credit": {

"rate": 1.5,

"percentage": false

},

"debit": {

"rate": 1.5,

"percentage": false

}

},

"amex": {

"debit": {

"rate": 1.5,

"percentage": false

}

}

}

}

}

| Attribute | Description |

|---|---|

_id |

ID of the company. |

name |

Name of the company. |

categories |

Categories of the company. A company may fall under multiple categories. |

status |

The operational status of the company at any given moment of time. Possible values are operational, maintenance. |

fullyAutomatedBill |

If true, then bill aggregation and payments are fully automated. Possible values are true, false. |

fullyAutomatedCardSwap |

If true, then swapping a card is fully automated. Possible values are true, false. |

logo |

Company logo object. |

logo.url |

URL of the company logo. |

logo.background |

If this is true, then the logo looks best as a background image. |

logo.svg |

Company logo svg object. |

logo.svg.url |

URL of the company svg logo. |

logo.svg.color |

Hex color of the company logo. |

requiredPayment |

If a specific payment method type is required by this company, this will be defined. Possible values are bank, card. |

userPresenceRequired |

If the company requires that the user is present to pass through any security flows. See best practices in the Connect documentation. |

schedule |

The bill payment schedule this company follows. If this parameter is set, the schedule for a bill linked to this company may not be changed. Typically subscription companies such as Netflix have this parameter set since payments must be made on a specific date. |

additionalPaymentOptions |

Present when the company provides additional payment options that allow users to make payments towards their outstanding balance. |

fees |

The surcharge object. Possible child objects are ach, cards |

fees.ach |

Present when the company applies surcharges to ACH payments. |

fees.ach.percentage |

If the ACH surcharge is a percentage of the payment amount. |

fees.ach.rate |

Either a dollar amount or a percentage amount. |

fees.cards |

Present when the company applies surcharges to card payments. Possible child objects are american express, discover, mastercard, and visa, referred to below as {cardBrand}. See example company response. |

fees.cards.{cardBrand} |

Possible child objects are credit or debit, referred to below as {cardType}. |

fees.cards.{cardBrand}.{cardType}.percentage |

If the surcharge is a percentage of the payment amount. |

fees.cards.{cardBrand}.{cardType}.rate |

Either a dollar amount or a percentage amount. |

auth |

Company auth fields. |

auth.urls |

Company Auth Urls (login URL is always available, but the others can by null). |

auth.urls.login |

Login URL. |

auth.urls.signup |

Signup URL. |

auth.urls.forgotPassword |

Forgot password URL. |

auth.urls.forgotUsername |

Forgot username URL. |

auth.loginFields |

Form fields for credentials. |

auth.loginFields.placeholder |

Input placeholder field. |

auth.loginFields.formType |

Input type field. |

auth.loginFields.name |

Input name field. |

auth.loginFields.label |

Label for input. |

geo |

Geo based location (not available for regional or national company). |

geo.lat |

Latitude coordinate. |

geo.lng |

Longitude coordinate. |

geo.stateShort |

Abbreviated state name. |

geo.stateLong |

Full state name. |

geo.zipcode |

Zipcode. |

geo.address |

Formatted address. |

Company logos

The Q2 Biller Direct API provides image URL's for each company's logo. For our most popular companies, we also provide a white svg logo, along with the hex color of the company's brand. There are three ideal ways of presenting these logos in your apps.

When the

company.logo.svgis available, the svg logo looks best on thecompany.logo.svg.colorbackground.

When the

company.logo.svgis not available and thecompany.logo.backgroundfield is set tofalse, the logo looks best on a white background.

When the

company.logo.svgis not available and thecompany.logo.backgroundfield is set totrue, the logo looks best as a background image with the company name overlaid on top.

Company categories

Example Request

curl "https://api.q2open.io/v1/company/categories" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-G

Example Response

{

"data": [{

"name": "Electric",

"type": "electric"

}]

}

Retrieve a list of company categories you can use to search for companies by category type.

HTTP Request

GET https://api.q2open.io/v1/company/categories

Returns

A dictionary with a data property that contains an array of company categories.

Retrieve a company

Example Request

curl "https://api.q2open.io/v1/company/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-G

Example Response

{

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"categories": ["streaming"],

"status": "operational",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false,

"svg": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.svg",

"color": "FF041F"

}

},

"requiredPayment": "bank",

"schedule": "on-due-date",

"auth": {

"urls": {

"login": "https://www.netflix.com/Login",

"signup": "https://www.netflix.com"

},

"loginFields": [{

"placeholder": "Username",

"formType": "text",

"name": "username",

"label": "Username"

}, {

"placeholder": "Password",

"formType": "password",

"name": "password",

"label": "Password"

}]

},

"geo": {

"lat": 30.70,

"lng": -95.53,

"state_short": "TX",

"state_long": "Texas",

"zipcode": "77340"

}

}

Retrieves the company with the given ID.

HTTP Request

GET https://api.q2open.io/v1/company/{companyId}

Arguments

| Parameter | Description |

|---|---|

companyId |

ID of company to retrieve. |

Returns

Returns a company object if a valid companyId was provided. Returns an error otherwise.

Search for companies

Example Requests

curl "https://api.q2open.io/v1/company/search" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"query": "Netflix"

"paginateResults": "true",

"pageSize": "25",

"pageNumber": "1",

"products": "['cardswap']"

}'

curl "https://api.q2open.io/v1/company/search" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"category": "gas"

}'

curl "https://api.q2open.io/v1/company/search" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"geo": {

"lat": 40.233845,

"lng": -111.65852

}

}'

Example Response

{

"data": [

{

"_id": "579b695decea110719b1874d",

"name": "Netflix",

"categories": ["streaming"],

"status": "operational",

"logo": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.png",

"background": false,

"svg": {

"url": "https://s3.amazonaws.com/app-assets.unbill.io-primary/uploads/utility-provider-logos/7242937ba29042cce61a8e4745269fce.svg",

"color": "FF041F"

}

},

"requiredPayment": "bank",

"schedule": "on-due-date",

"auth": {

"urls": {

"login": "https://www.netflix.com/Login",

"signup": "https://www.netflix.com"

},

"loginFields": [{

"placeholder": "Username",

"formType": "text",

"name": "username",

"label": "Username"

}, {

"placeholder": "Password",

"formType": "password",

"name": "password",

"label": "Password"

}]

},

"geo": {

"lat": 30.70,

"lng": -95.53,

"state_short": "TX",

"state_long": "Texas",

"zipcode": "77340"

}

}

],

"resultCount": 1

}

Search for companies by name, category, or nearby a geo coordinate.

HTTP Request

POST https://api.q2open.io/v1/company/search

Arguments

| Parameter | Description |

|---|---|

query |

The text string on which to search companies by name. |

category |

Category type retrieved from the /company/categories endpoint. |

geo |

Geo coordinates to search companies by location. |

geo.lat |

Latitude coordinate. |

geo.lng |

Longitude coordinate. |

paginateResults |

Boolean that enables returning paginated results. |

pageSize |

Used with paginateResults to set page size (Max 100). |

pageNumber |

Used with paginateResults to set which page of results gets returned in the data. |

products |

Product type that is enabled on the companies. This parameter is to be an array with string values biller-direct and cardswap as options. |

Returns

A dictionary with a data property that contains an array of company objects that match the provided search filters. If paginateResults is true, this also includes resultCount which is the total count of matching companies.

Payment

In order to make payments towards a user's bill, they must first link a payment method using the /payment endpoint. By default, after a payment method is linked, payments will be made towards a user's bills on time. The API allows you to add and retrieve a user's payment method, as well as make payments towards a bill's outstanding balance and cancel a scheduled payment.

The card object

Example Response

{

"number": "XXXX0005",

"brand": "american express",

"type": "credit",

"expDate": "2019-06-01T12:00:00.000Z"

}

| Attribute | Description |

|---|---|

number |

Masked card number. |

brand |

Card brand. Possible values are visa, mastercard, american express, etc. |

type |

Card type. Possible values are credit, debit. |

expDate |

Card expiration date. |

The bank object

Example Response

{

"routingNumber": "XXXX0002",

"accountNumber": "XXXX0021",

"type": "checking"

}

| Attribute | Description |

|---|---|

routingNumber |

Masked routing number. |

accountNumber |

Masked account number. |

type |

Bank account type. Possible values are checking, savings. |

The payment method object

Example Response

{

"_id": "580e3e11dec21e861b5a3719",

"type": "card",

"identifier": "optional_custom_identifier",

"status": "verified",

"default": true,

"card": {

"number": "XXXX0005",

"brand": "american express",

"type": "credit",

"expDate": "2019-06-01T12:00:00.000Z"

},

"assignedBills": [ "580e3e11dec21e861b5a3719" ]

}

| Attribute | Description |

|---|---|

_id |

ID of the payment method. |

type |

The type of the payment method on file. Possible values are card, bank. |

identifier |

Optional custom identifier for external system correlation. |

status |

The status of the payment method on file. Possible values are verified, declined. |

default |

If this is the default payment method. Default means that it will pay any bills not specifically assigned a payment method. |

assignedBills |

A list of bill ID's this payment method was specifically assigned to. |

card |

Card object |

bank |

Bank object |

Payment status

A payment method can have one of three statuses. Each type is documented below with a description of the status and a typical use case.

verified

The payment method on file is verified and eligible to make payments.

declined

The payment method on file is not eligible to make payments. This may happen for a number of reasons including:

- Insufficient funds

- Expired card

- Closed bank account

When a user's payment method fails to pay a bill, we set their payment method status as declined. While their status is declined no bill payments will be made in behalf of the user. To address this issue, you may take one of the following courses of action:

- Link a new payment method via the

/paymentendpoint. - Retry the payment method via the

/payment/{paymentMethodId}/retryendpoint.

Declined payment prompt

If their payment method continues to be declined, it will be removed from their account. If the removed payment method was the default, the user will need to link a new payment method or choose another payment method on file as their default before bill payment services resume.

Add a payment method

Example Card Request

curl "https://api.q2open.io/v1/payment" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"clientId": "56e1ddbd1a05319bc198d36f",

"paymentType": "card",

"identifier": "optional_custom_identifier",

"cardNumber": "378282246310005",

"cardCode": "218",

"expMonth": "10",

"expYear": "2017",

"zipcode": "12345",

"name": "Demo User",

"setAsDefault": true,

"customLabel": "Entertainment Rewards Card"

}'

Example Bank Request

curl "https://api.q2open.io/v1/payment" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"clientId": "56e1ddbd1a05319bc198d36f",

"paymentType": "bank",

"identifier": "optional_custom_identifier",

"routingNumber": "021000021",

"accountNumber": "9900000002",

"accountType": "checking",

"name": "Demo User",

"customLabel": "For Utilities"

}'

Example Response

{

"paymentMethodId": "56e1ddbd1a05319bc198d36f"

}

Add a payment method to a user.

HTTP Request

POST https://api.q2open.io/v1/payment

Arguments

| Parameter | Description |

|---|---|

clientId |

ID of the client to add a payment method to. |

paymentType |

Type of payment. Possible values are card, bank. |

identifier |

Optional custom identifier for external system correlation. |

cardNumber |

Credit card number. |

cardCode |

Credit card CVV. |

expMonth |

Credit card expiration month formatted as XX. |

expYear |

Credit card expiration year formatted as XXXX. |

zipcode |

Credit card zipcode. |

name |

The name as it appears on the payment account. |

routingNumber |

Bank routing number. |

accountNumber |

Bank account number. |

accountType |

Type of bank account. Possible values are checking, savings. |

setAsDefault |

Set this payment method as the default. |

customLabel |

Used for letting the user set a custom display name for this account. |

Returns

Returns an object with a paymentMethodId property if the payment method was successfully added. Returns an error otherwise.

List all payment methods

Example Request

curl "https://api.q2open.io/v1/payment/list/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-G

Example Response

{

"data": [

{

"_id": "580e3754dec21e861b5a3718",

"type": "card",

"identifier": "optional_custom_identifier",

"status": "verified",

"default": true,

"name": "Demo User",

"card": {

"number": "XXXX4242",

"brand": "visa",

"type": "credit",

"expDate": "2016-12-01T12:00:00.000Z"

}

},

{

"_id": "580e3e11dec21e861b5a3719",

"type": "bank",

"identifier": "optional_custom_identifier",

"status": "declined",

"name": "Demo User",

"bank": {

"routing": "XXXX2531",

"account": "XXXX4124",

"type": "checking"

}

}

]

}

Retrieve a list of payment methods on file for a client.

HTTP Request

GET https://api.q2open.io/v1/payment/list/{clientId}

Arguments

| Parameter | Description |

|---|---|

clientId |

ID of client to retrieve payment methods for. |

Returns

A dictionary with a data property that contains an array of payment method objects.

Delete payment method

Example Request

curl "https://api.q2open.io/v1/payment/566595c8ce88ccec69328566" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-X DELETE

Example Response

{

"success": true

}

Delete a payment method on file for bill payments. If a payment was made within the last 24 hours with this payment method, an error will be returned. Q2 requires a 24 hour time span after a payment has been made before a payment method can be deleted.

HTTP Request

DELETE https://api.q2open.io/v1/payment/{paymentMethodId}

Arguments

| Parameter | Description |

|---|---|

paymentMethodId |

ID of payment method to delete. |

Returns

Returns an object with a success property if the payment method was deleted. Returns an error otherwise.

Retry payment method

Sample Request

curl "https://api.q2open.io/v1/payment/566595c8ce88ccec69328566/retry" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-X POST

Example Response

{

"success": true

}

Retry a declined payment method on file for bill payments.

HTTP Request

POST https://api.q2open.io/v1/payment/{paymentMethodId}/retry

Arguments

| Parameter | Description |

|---|---|

paymentMethodId |

ID of payment method to retry. |

Returns

Returns an object with a success property if the payment method will be retried. Returns an error otherwise.

Assign payment method

Example Request

curl "https://api.q2open.io/v1/payment/566595c8ce88ccec69328566/assign" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"billId": "566595c8ce88ccec69328566",

}'

-X POST

Example Response

{

"success": true

}

Assign a linked payment method to pay a specific bill. This is required when a company's requiredPayment is defined as card or bank.

HTTP Request

POST https://api.q2open.io/v1/payment/{paymentMethodId}/assign

Arguments

| Parameter | Description |

|---|---|

paymentMethodId |

ID of payment method to assign. |

billId |

ID of bill to assign payment method to. |

Returns

Returns an object with a success property if the payment method was assigned. Returns an error otherwise.

Update payment settings

Example Request

curl "https://api.q2open.io/v1/payment/settings" \

-H "Authorization: Bearer dc220490-e6ee-11e5-8a94-e7385a8d929e" \

-H "Content-Type: application/json" \

-d '{

"billId": "566595c8ce88ccec69328566",

"recurring": "enabled",

"schedule": "five-days-before"

}'

-X POST

Example Response

Update payment settings for a bill.